Balance this exceptional employee benefit with compliance and administrative ease.

Introduction

Employee Stock Purchase Plans (ESPPs) are common among public companies, and it is easy to see why. On the participant side, ESPPs allow a large population of employees to build wealth through the purchase of company stock, typically at a discount to the market price. Beyond the monetary benefit, ESPPs create a culture of ownership, which can raise engagement and increase retention. From the company’s perspective, ESPPs have relatively low compensation expense and even provide some additional cash flow.

Many ESPPs allow employees to contribute a portion of their paycheck over a certain “offering period” (typically one to six months) to purchase company stock at a discount (typically 5% to 15%). Some plans even contain a “look-back” feature, such that the purchase price is based on the lower of the price at the beginning of the offering period and the end of the offering period. The greater the benefit offered, the greater the participation. A 2020 Fidelity study[1] of ESPP and 401(k) clients found that employees in the lowest income quartile of the company don’t participate in the ESPP in a meaningful way unless the plan offers a 15% discount with a look-back. This means that companies that truly want to target broad-based participation among employees of all income levels need to maximize the benefits offered with a discount and a look-back and make sure the benefits are well communicated to employees. But some plans go even further.

The “Cadillac” ESPP

“Cadillac” plans take the features of a typical ESPP and stretch them to the maximum while still remaining tax qualified under Section 423(b).

A typical Cadillac ESPP will include:

- Twenty-four month offering period with four six-month purchase period.

- 15% discount with a look-back to the beginning stock price.

- Automatic rollover if stock price decreases on a purchase date. A rollover cancels the remaining purchase periods in the offering and re-enrolls everyone in a new offering based on the lower price.

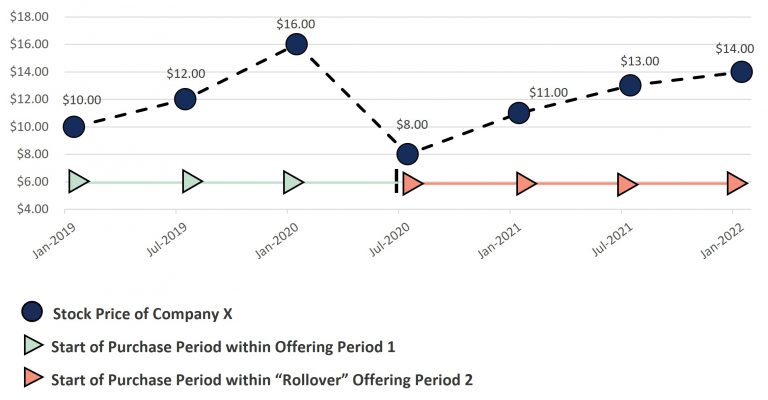

Let’s look at an example of how a Cadillac plan operates, using the plan features described above. The chart below shows the stock price of our example company (Company X) over time.

| Step | Offering Period Start | Purchase Period | Price at Beginning of Offering Period | Price on Purchase Date | Purchase Price | Gain at Purchase |

|---|---|---|---|---|---|---|

| 1 | 1/1/2019 | 1/1/2019 to 6/30/2019 | $10.00 | $12.00 | $8.50 | $3.50 |

| 2 | 1/1/2019 | 7/1/2019 to 12/31/2019 | $10.00 | $16.00 | $8.50 | $7.50 |

| 3 | 1/1/2019 | 1/1/2020 to 6/30/2020 | $10.00 | $8.00 | $6.80 | $1.20 |

| 3 | ||||||

| 3 | 7/1/2020 | 7/1/2020 to 12/31/2020 | $8.00 | $11.00 | $6.80 | $4.20 |

| 4 | 7/1/2020 | 1/1/2021 to 6/30/2021 | $8.00 | $13.00 | $6.80 | $6.20 |

| 4 | 7/1/2020 | 7/1/2021 to 12/31/2021 | $8.00 | $14.00 | $6.80 | $7.20 |

- In the first purchase period, Company X’s stock price rises from $10 to $12. The employee can purchase shares at $8.50 (85% of the lesser of $10 and $12) and remains in the original offering period that started on 1/1/2019.

- In the second purchase period, Company X’s stock price again increases, up to $16. The employee can purchase shares at 85% of the lesser of the price at the beginning of the offering period (still $10) and the current price. The purchase price is still $8.50, and the employee remains in the 1/1/2019 offering period.

- By the end of the third purchase period, the stock price has dropped to $8.00. The purchase price is now 85% of the lesser of $10 and $8, which equals $6.80. Now, because the price has dropped below the original $10 offering price, a “rollover” occurs. The 1/1/2019 offering is closed, and a new twenty-four month offering period starts on 7/1/2020, with an offering price of $8.00.

- The price continues to rise steadily for purchases that occur on 12/31/2020, 6/30/2021, and 12/31/2021. Each of these purchases are made at a purchase price of $6.80, equal to 85% of the stock price on the first day of the new offering period.

If an employee were to contribute $1,000 per purchase period, they would have purchased 822 shares by the end of the three-year period.

| Purchase Period | Purchase Price | Contributions | Shares Purchased | Pre-Tax Value on 12/31/2021 | Return |

|---|---|---|---|---|---|

| 1/1/2019 to 6/30/2019 | $8.50 | $1,000 | 117 | $1,638 | 63.8% |

| 7/1/2019 to 12/31/2019 | $8.50 | $1,000 | 117 | $1,638 | 63.8% |

| 1/1/2020 to 6/30/2020 | $6.80 | $1,000 | 147 | $2,058 | 105.8% |

| 7/1/2020 to 12/31/2020 | $6.80 | $1,000 | 147 | $2,058 | 105.8% |

| 1/1/2021 to 6/30/2021 | $6.80 | $1,000 | 147 | $2,058 | 105.8% |

| 7/1/2021 to 12/31/2021 | $6.80 | $1,000 | 147 | $2,058 | 105.8% |

| Total | $6,000 | 822 | $11,508 | 91.8% |

At the current $14.00 share price, they hold approximately $11,500 in value for their $6,000 investment, which represents a return of over 90%!

As seen above, Cadillac ESPPs provide a tremendous benefit to the employee, and therefore can be powerful recruitment and retention tools. However, these plans also present a few challenges, as they are more difficult to administer and account for. Each time a rollover occurs, the company must recognize incremental expense to account for the fact the offering price has been lowered, while continuing to recognize the expense associated with the original offering period. If the stock price continues to decline, companies may end up tracking multiple rollovers and layers of incremental expense.

Design Decisions

While we outlined the most common form of the Cadillac plan above, not all follow the same pattern. There are several decisions to make when implementing an ESPP.

- Discount: Companies can offer up to a 15% discount when purchasing shares and still maintain tax qualified status under 423(b).

- Length of Offering Period and Purchase Period(s): Most ESPP offering periods are either three months long (33% of tax-qualified plans) or six months long (54% of tax-qualified plans). However, Cadillac plans often have much longer offering periods, with multiple purchase periods within each offering. If the award contains a “look-back” feature, the maximum offering period length under 423(b) is 27 months. The most common offering period for a Cadillac program is 24 months.

- Reset or Rollover: A reset feature and a rollover feature both ensure that employees are purchasing shares based off the lowest possible price but differ slightly in their mechanics. A rollover was illustrated above, with a new offering period starting anytime the stock price on a purchase date was lower than the stock price on the offering date. A reset feature lowers the “look-back” price if the stock price on a purchase date is lower than the original offering period but does not start a new offering period.

- Contribution Changes: Some companies allow employees to change their contribution rate during the offering period, either at certain defined intervals (e.g., the start of a new purchase period) or anytime. If an employee increases their contributions during an offering period, incremental expense must be calculated based on the facts and circumstances at the time of the contribution increase. This can increase accounting complexity and compensation expense. On the other hand, decreases in contributions or withdrawals without a terminating event are ignored for expense purposes.

- New Entrants: Let’s say a newly public company implements a Cadillac ESPP with a two-year offering period and four six-month purchase periods. Three months into the first purchase period, a new employee is hired that would like to participate in the ESPP. Companies typically proceed one of two ways. First, the company could start a new two-year offering after the first purchase is complete, which the new employee (and any other new hires or new enrollees) could join. Alternatively, companies could create a new offering period that ends on the same date as the original offering period. New entrants that join an existing offering period will participate in the remaining purchases but will have a different purchase price based on the fair market value at the time they entered.

Alternatives to Full Cadillac

A full Cadillac plan may be the best choice for some companies, but others may want to offer attractive ESPPs without incurring the full expense and complication of a Cadillac. Companies in this situation could consider the following:

- Twelve-month Offering Period: When combined with a look-back feature, a longer offering period can provide extra benefits to employees when the company experiences a stock price run-up by locking in the purchase price at an even earlier date. A twelve-month offering period can be a nice compromise between a typical ESPP (three to six-month offering period) and the two-year offering period of a Cadillac plan. Alternatively, companies could offer a full two-year offering period, but without the four separate purchase periods (i.e., single, twenty-four-month purchase).

- Reset Instead of Rollover: Including a reset feature into a plan with multiple purchase periods within an offering period allows employees to purchase at lower prices within the offering period, without creating the administrative headache of starting a whole new offering period.

- Full Cadillac to Single Six-Month Offering Period: A company’s initial offering could be a Cadillac plan to drive participation, followed by simpler six-month offerings. A Cadillac plan typically starts a new two-year offering whenever the price drops. However, companies could elect to roll-over into a shorter offering period (e.g., six months) when a rollover occurs. If no rollover occurs, six-month offerings begin after the initial two-year period. This feature may be especially attractive to companies going public. Employees lock in the IPO price for potentially 2 years. However, if the stock price drops before the end of the 2-year period, the ongoing administration becomes much easier since there is no possibility of multiple rollovers.

Accounting Made Easier

The accounting for a full Cadillac ESPP can be challenging and often requires a solution outside of the core administrative system. However, with a proper understanding of which offering period employees belong to (“offering period cohort”) and how many roll-overs occurred in the prior 24 months, estimating the expense impact can be significantly simplified in most cases. In fact, the process for each offering period cohort can be reduced to estimating contributions and expressing the expense as a ratio of dollars contributed (e.g., 50 cents of expense per dollar contributed). Note that this process to estimate the expense is accurate for employees who are not limited in their ability to purchase additional shares with a stock price decline, which generally covers the vast majority of participants. Employees reaching share plan limits who are not able to utilize their full contributions to purchase additional shares should be carved out, as this method would overestimate their expense.

The example below looks at the last purchase period within a 24-month offering period, assuming the following:

- Offering date price of $10

- 15% discount

- Original fair value of $3

- Rollover at 12 months (when the stock price drops to $8) and 18 months (when the stock price drops to $6)

- Estimated contributions of $10,000 per purchase period

As illustrated below, the only values needed to estimate expense are i) contribution totals and ii) fair values on grant date and at rollover dates.

| As Of | Stock Price | Fair Value Before Rollover | Fair Value After Rollover | Fair Value Factor Before Rollover 1 | Fair Value Factor After Rollover 2 | Expense Factor 3 | Expense 4 |

|---|---|---|---|---|---|---|---|

| Offer Date | $10.00 | n/a | $3.00 | n/a | 30.0% | 35.3% | $3,529 |

| Offer Date + 12 Months | $8.00 | $2.20 | $2.50 | 22.0% | 31.3% | 10.9% | $1,088 |

| Offer Date + 18 Months | $6.00 | $1.70 | $1.90 | 21.3% | 31.7% | 12.3% | $1,225 |

| Total | $5,843 | ||||||

| 1 [Fair Value Before Rollover] / [Previous Stock Price] | |||||||

| 2 [Fair Value After Rollover] / [Stock Price] | |||||||

| 3 ([Fair Value Factor After Rollover] – [Fair Value Factor Before Rollover]) / 0.85 | |||||||

| 4 $10,000 x [Expense Factor] | |||||||

Conclusion

Cadillac ESPPs are a fantastic way to attract talent, retain employees, increase engagement, and allow the general population of employees to participate in stock price growth. Even after stretching most plan design features to their maximum allowable position under Section 423(b), Cadillac ESPPs are still typically inexpensive relative to a company’s overall compensation expense. Companies with Cadillac plans or that adopt Cadillac plans should make sure employees are aware of the benefits available to them to fully maximize participation and appreciation of the plan. In some regions and sectors, like Silicon Valley, ESPPs are a crucial part of compensation packages for lower to mid-level employees and can be the difference between landing a top recruit or keeping talented employees from leaving.

[1] Based on Fidelity’s internal analysis as of 12/31/2019 of 99 Fidelity clients with 401(k) and ESPP.